NPS or National Pension System was started in 2004, initially for government employees only. It was opened for all in 2009. It is a social security initiative similar to 401(k) plans in the United States. The NPS invests the contributions of its subscribers into various market linked instruments such as equities and debt and the final pension amount depends on the performance of these investments.

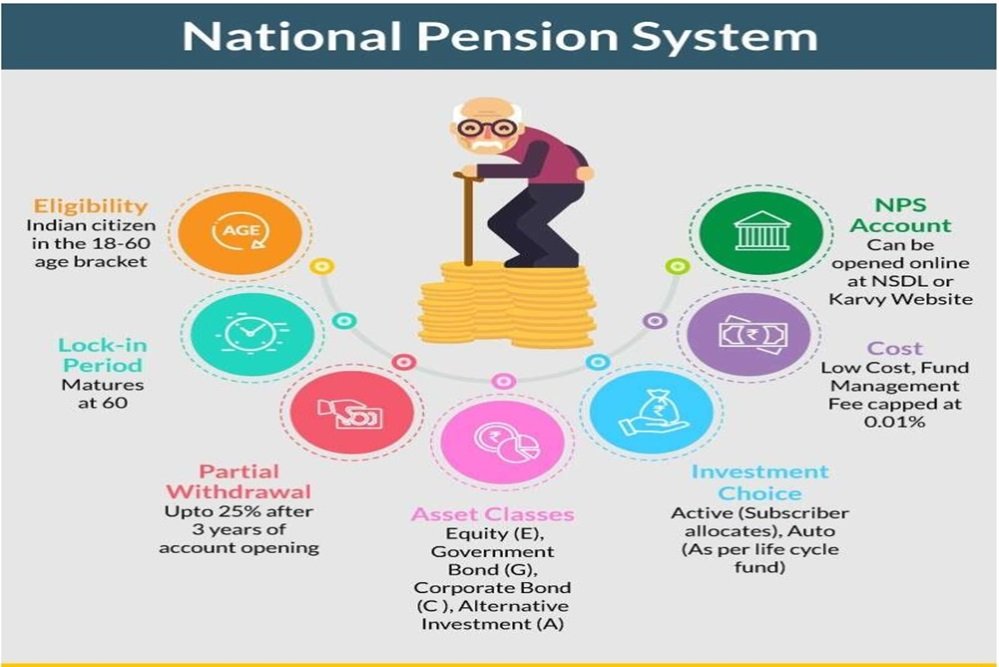

Any Indian citizen in the age group of 18-60 can open an NPS account. The NPS matures at the age of 60 but can be extended until the age of 70.

How we are incentivised to invest in the NPS?

Favorable tax regimes are one of the major drivers that determine investment decisions.

Section 80C

The amount of tax saved is equal to the amount invested multiplied by your tax rate. E.g. Someone in the 20% tax bracket invests 1 lakh in section 80C, the total tax saved will be Rs. 20,800 (20.8 * 1 lakh).

The maximum tax deduction that one can claim under this section is Rs. 1.5 lakh.

Someone in the 30% tax bracket and investing 1.5 lakh, can save tax up to Rs. 46,800 (31.2 * 1.5 lakh).

Some of the eligible investments in the 80C basket are

o Provident Fund

o Fixed Deposits (Five year)

o Equity Linked Savings Schemes (ELSS)

o Senior Citizens Saving Scheme (SCSS)

o National Pension Scheme (NPS)

There are a lot of options under Sec 80C so it is not necessary to save with NPS to avail these benefits.

Section 80CCD (1B)

This section allows investment of Rs. 50k over and above the 1.5 lakh under 80c. This additional investment is allowed only in NPS, which can help reduce tax up to Rs. 15.6k.

Is this compelling enough to invest in NPS? For this, let’s understand NPS better.

NPS corpus is not tax free on maturity

The tax treatment of the corpus is the primary reason many investors are not joining the NPS. Only 60% of the corpus is tax free and the rest has to be invested in an annuity.

An investment of Rs 50 lakh will yield a monthly pension of about Rs 30,000-32,000. If the person lives for 20 years in retirement, the return works out to barely 6.2%.

The other problem is that the pension from the annuity is fully taxable as income at the normal rates. The pension from an annuity is a mix of the principal and the gain. The investor effectively pays tax not only on the gains but also on the invested capital.

No withdrawals till retirement at 60

The rigid rules for withdrawals reduce the attractiveness of the NPS. During the productive years of a person, there are multiple occasions when one might need money. At this stage, inaccessibility to one’s own funds curbs a person’s financial freedom.

NPS does give the investor the option to exit before 60. But 80% of the accumulated corpus will have to be put in an annuity and only 20% will be available. It does allow the investor to make partial withdrawals of up to 25% of the contributed amount but there are restrictions here. Like one can withdraw only for children’s wedding or higher studies, building/buying a house or medical treatment of self/family members.

To conclude, investment choices should not be guided merely by tax savings. Take into consideration your risk profile and asset allocation.

Avail benefits under 80C by investing in ELSS or PF or SCSS. Regarding 80CCD, with many of us considering retirement before 60, the age-based exit rule is impractical. Don’t complicate your portfolio by investing in NPS for tax-saving.